Reluctant to Outsource Investment Management? You Shouldn't Be

For many advisors, the decision to outsource investment management turns on a desire to elevate their business. This is particularly true for fee-based and fee-only advisors who’d like to deliver more value-added services to clients but are already working at full capacity. Outsourcing offers an attractive way to free up the substantial time they direct to portfolio management while also providing their clients with more diverse—and potentially better—investment solutions.

So what’s the problem? Often, advisors are reluctant to outsource because they worry about:

Losing control over the investment process

Taxation ramifications of moving accounts

Potentially higher costs for their clients or themselves

These days, however, such presumed obstacles are much more myth than reality. To get to the heart of the matter, let’s take a look at the key reasons why outsourcing investment management has become a game changer for many advisors.

Why Outsourcing Doesn’t Mean Losing Control

The reality of today’s outsourcing programs is that you can continue to play a critical role in the management process.

It’s up to you to choose which managers you want to use for your outsourced accounts—and there are a variety of options available, from turnkey asset management programs (TAMPs) provided by third parties to in-house managed portfolio models that may be offered by your firm partner. By monitoring the managers’ process and performance and picking the right model allocation for clients’ risk tolerance and investment objectives, you retain meaningful control over monies held in these accounts.

In addition, outsourcing is not an all-or-nothing proposition. One common solution is to take a hybrid approach. For example, you might continue to self-manage nonqualified accounts and to outsource retirement accounts that qualify for tax advantages. The rationale for this approach is to avoid the potential for tax ramifications when moving nonqualified assets that have appreciated.

How Outsourcing Can Help Raise the Value Your Firm Delivers to Clients

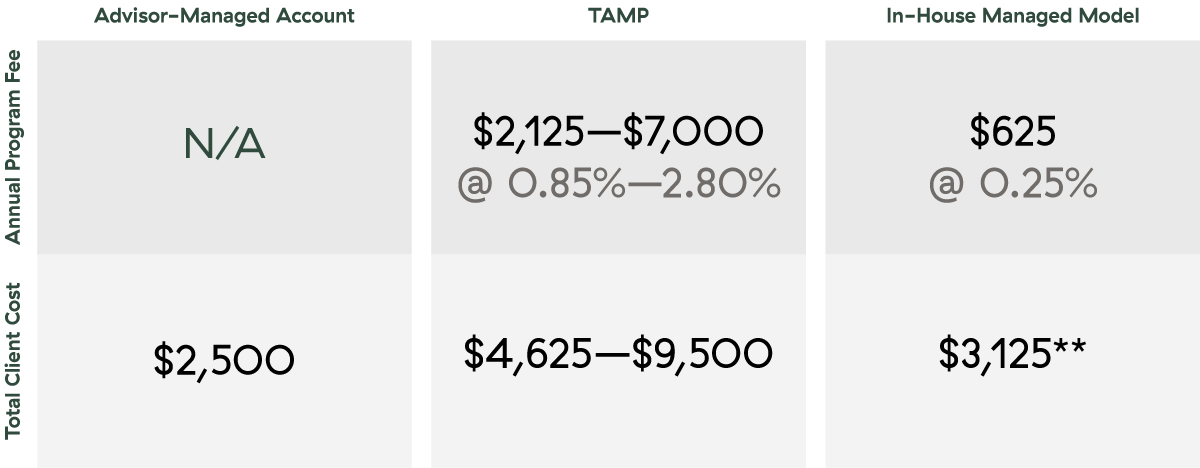

Outsourcing investment management involves an additional client cost, usually in the form of a program fee. The chart below compares average client costs for a hypothetical advisor-managed portfolio, a TAMP, and an in-house managed model you might access through your firm partner. The program fees for TAMPs can vary widely, with some reports estimating the cost at 0.85 percent to 2.8 percent, depending on the complexity of the program chosen and the investments used.

Average Client Costs

Assumptions:

$250,000 Account

Annual Advisor Fee @ 1%: $2,500*

Source: Commonwealth. This is a hypothetical example for illustrative purposes only.

*This amount may differ based on your firm’s payout policy.

**Amounts based on a traditional actively managed model on Commonwealth’s Preferred Portfolio Services® platform. Depending on the security type used within the model, the overall fees (in addition to the standard advisor fee) could rise to 0.65% ($1,625).

Depending on the program chosen, the extra fees to your client could be substantial. It may not be in their best interest, for example, to outsource a $250,000 account to a TAMP charging a program fee of more than 2 percent. But for an extra 25 bps to 100 bps, many clients might consider the additional cost acceptable given the potential benefits they’ll receive.

Here are some reasons outsourced investing solutions can help raise the value your firm delivers to clients:

Given the diversity of managed solutions available, you’ll be able to select the appropriate model portfolios and managers for each client, potentially meeting their needs more effectively.

Many managed products can demonstrate a solid track record across model types, thus offering clients a clear, understandable story regarding investment suitability and performance.

Managed accounts can facilitate the diversification of clients’ product choices by offering solutions that may fall outside your areas of expertise, such as alternatives or options strategies.

Clients can review a portfolio’s historical performance (subject to your firm’s compliance approval).

With someone else managing the assets, clients get more time with you, so you can both work on deepening your relationship.

The value of these factors cannot be quantified, of course. But once you discuss the reality of outsourcing with your clients, you may find that the program fee is not an impediment for them—or a reason to reduce your fees.

How Outsourcing Saves Time and Drives Efficiency

Advisors who choose to build and manage client portfolios spend a substantial amount of time (or staff resources) on asset research, due diligence, investment reporting, trading and rebalancing, and other managerial tasks.

By outsourcing the major lift involved with these tasks, you can gain back that time, which you can then devote to client-facing planning work and other revenue-generating activities. Take a recent 2020–2021 study conducted by Commonwealth in partnership with Cerulli Associates. It found that Commonwealth advisors spend 29 percent less time on trading and rebalancing and 22 percent less time on research, due diligence, and portfolio monitoring than other advisors, such as those at wirehouses. That speaks to the strong adoption rate of Commonwealth’s outsourcing solutions, as well as to the technology tools and research guidance offered to its affiliated advisors.

Outsourcing can also mitigate the business risks of investment staff leaving your firm. When you manage your own portfolios and a key staff member leaves, your firm’s operations could be disrupted, leaving you shorthanded in the interim.

In short, outsourcing could greatly improve the scale and efficiency of your firm.

Making the Right Move

Managed portfolio solutions are not right for every advisor or client. To help guide your decision, ask yourself the following questions:

Is your passion talking to clients or choosing investments?

Where do your talents lie? Can you build solid portfolios, or are you better at financial planning?

Are you looking to grow the firm or achieve a better work-life balance?

What choice is in your clients’ best interest?

If you decide that outsourcing investment management is the right move, it’s important to conduct due diligence so you fully understand the philosophy, historical performance, and costs of a platform’s options. Ideally, your firm partner will have the resources to help you navigate potential solutions and expand your reach to include more holistic wealth management.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.